Empowering Women Through Financial Literacy

In today's world, financial independence is crucial for women. It allows them to make their own choices, pursue their dreams, and secure their future. One of the most effective ways to achieve financial empowerment is through education. Reading personal finance books specifically tailored for women can provide the knowledge and tools needed to navigate the complex world of money management and build a strong financial foundation.

Why Focus on Personal Finance Books for Women?

While general personal finance advice is valuable, books designed for women often address unique challenges and perspectives. These books acknowledge the gender pay gap, career breaks, and longer life expectancies that can impact women's financial planning. They also tend to focus on topics like negotiating salaries, investing with confidence, and building wealth in a way that aligns with women's values and goals.

Top Personal Finance Books for Women

1. "Broke Millennial Takes on Investing: A Beginner's Guide to Leveling Up Your Money" by Erin Lowry

Erin Lowry's "Broke Millennial Takes on Investing" is a fantastic starting point for women who are new to the world of investing. Lowry breaks down complex concepts into easy-to-understand language, making investing less intimidating and more accessible. The book covers essential topics such as understanding different investment options, building a diversified portfolio, and managing risk. It’s particularly helpful for millennials and Gen Z women who are just starting their financial journey.

2. "Clever Girl Finance: Learn How Investing Works, Grow Your Money" by Bola Sokunbi

Bola Sokunbi's "Clever Girl Finance" is a comprehensive guide to personal finance for women. It covers a wide range of topics, from budgeting and saving to investing and debt management. Sokunbi's approach is practical and empowering, encouraging women to take control of their finances and build wealth. The book also emphasizes the importance of financial literacy and provides actionable steps to improve your financial situation.

3. "You Are a Badass at Making Money: Master the Mindset of Wealth" by Jen Sincero

While not strictly a personal finance book, Jen Sincero's "You Are a Badass at Making Money" focuses on the mindset required for financial success. Sincero challenges limiting beliefs about money and encourages readers to embrace their potential for wealth. This book is perfect for women who struggle with money mindset issues, such as feeling unworthy of wealth or having negative associations with money. By changing your mindset, you can open yourself up to new opportunities and create a more abundant financial life.

4. "Prince Charming Isn't Coming: How Women Get Smart About Money" by Barbara Stanny

Barbara Stanny's "Prince Charming Isn't Coming" is a classic personal finance book for women. Stanny emphasizes the importance of financial independence for women and encourages them to take responsibility for their own financial futures. The book covers topics such as investing, retirement planning, and estate planning. It also addresses the unique challenges that women face in the financial world, such as the gender pay gap and the impact of career breaks on retirement savings.

5. "Women & Money: Owning the Power to Control Your Destiny" by Suze Orman

Suze Orman's "Women & Money" is a comprehensive guide to personal finance that addresses the specific challenges and opportunities that women face. Orman provides practical advice on a wide range of topics, including budgeting, saving, investing, and debt management. She also emphasizes the importance of financial planning for retirement and long-term care. Orman's no-nonsense approach and clear explanations make this book a valuable resource for women of all ages and financial backgrounds.

6. "The Latte Factor: Why You Don't Have to Be Rich to Live Rich" by David Bach

David Bach's "The Latte Factor" is a simple yet powerful book that demonstrates how small changes in your spending habits can have a significant impact on your financial future. The book focuses on the concept of the "latte factor," which refers to the small, everyday expenses that can add up over time. By cutting back on these expenses and investing the savings, you can build wealth and achieve your financial goals. This book is perfect for women who are struggling to save money or who want to make small changes that will have a big impact.

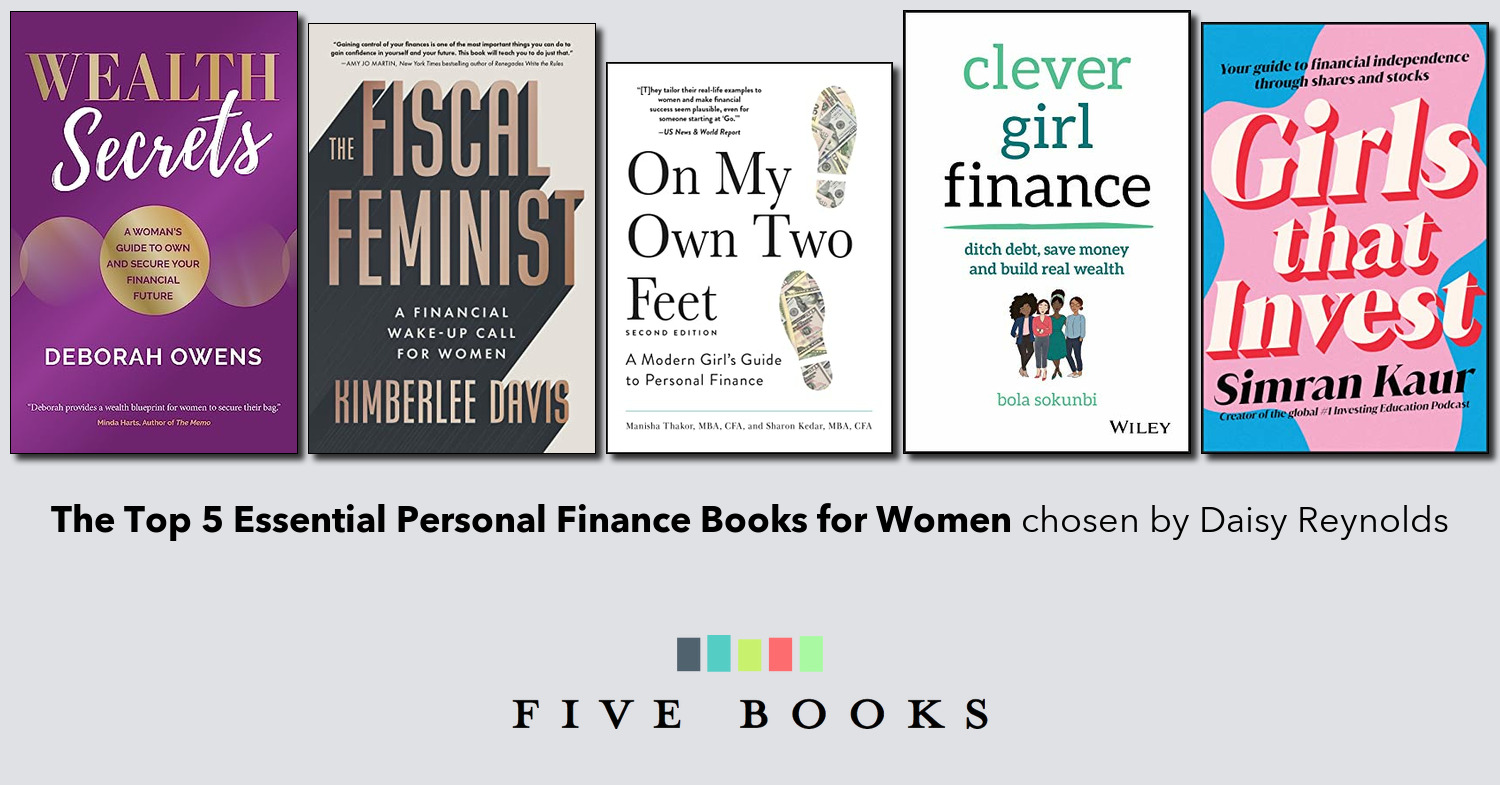

7. "On My Own Two Feet: A Modern Girl's Guide to Personal Finance" by Manisha Thakor and Sharon Kedar

“On My Own Two Feet” by Manisha Thakor and Sharon Kedar is a practical and relatable guide designed specifically for young women navigating the complexities of personal finance. It offers a down-to-earth approach to budgeting, saving, investing, and managing debt, addressing topics like student loans, career choices, and relationships with money. The book emphasizes building a solid financial foundation and empowering women to take control of their financial futures with confidence.

8. "The Total Money Makeover" by Dave Ramsey

While not explicitly targeted towards women, Dave Ramsey's "The Total Money Makeover" provides a straightforward and effective plan for getting out of debt and building wealth. Ramsey's approach is based on the principle of paying off debt using the "debt snowball" method, which involves paying off the smallest debt first to gain momentum. This book is perfect for women who are struggling with debt and want a clear and actionable plan to get their finances back on track.

Beyond the Books: Continuing Your Financial Education

Reading personal finance books is a great starting point, but it's important to continue your financial education beyond the pages. Consider attending workshops, taking online courses, and working with a financial advisor to further enhance your knowledge and skills. Stay informed about current financial trends and market conditions, and don't be afraid to ask questions and seek advice from trusted sources. The more you learn, the more confident and empowered you will be in managing your finances.

Taking Action: Implementing What You Learn

The most important thing is to take action and implement what you learn from these books. Start by creating a budget, setting financial goals, and developing a plan to achieve them. Track your spending, pay off debt, and start investing. Remember that financial empowerment is a journey, not a destination. By consistently learning and taking action, you can build a secure and fulfilling financial future for yourself.

0 Comments