What is a Self-Directed IRA?

A Self-Directed IRA (SDIRA) is a type of individual retirement account that allows you to invest in a wider range of assets than a traditional IRA. While traditional IRAs typically limit investments to stocks, bonds, and mutual funds, an SDIRA opens the door to alternative investments, including real estate, precious metals, private equity, and more.

The key difference lies in the custodian. Traditional IRA custodians typically specialize in mainstream investments. SDIRA custodians, on the other hand, are equipped to handle the complexities of alternative assets. They act as administrators, ensuring your investments comply with IRS regulations, but they generally don't offer investment advice or due diligence.

Why Invest in Real Estate with a Self-Directed IRA?

Investing in real estate through a Self-Directed IRA offers several potential advantages:

Tax Benefits

One of the most significant benefits is the tax-advantaged nature of an IRA. Depending on the type of SDIRA (Traditional or Roth), your real estate investments can grow either tax-deferred or tax-free. With a Traditional SDIRA, your contributions may be tax-deductible, and your earnings grow tax-deferred until retirement. With a Roth SDIRA, you contribute after-tax dollars, but your earnings and withdrawals in retirement are tax-free, provided you meet certain requirements.

Diversification

Real estate can provide valuable diversification to your retirement portfolio. It's often uncorrelated with the stock market, meaning its performance isn't directly tied to market fluctuations. This can help reduce overall portfolio volatility and potentially improve long-term returns.

Potential for Higher Returns

Real estate offers the potential for both cash flow (rental income) and appreciation (increase in property value). If you successfully identify and manage your properties, you could generate significant returns within your SDIRA.

Control Over Your Investments

With an SDIRA, you have direct control over your real estate investments. You choose the properties, manage the renovations (if any), and handle the tenant relationships. This level of control allows you to leverage your expertise and make investment decisions that align with your risk tolerance and financial goals.

Types of Real Estate You Can Invest In

A Self-Directed IRA allows you to invest in a variety of real estate types, including:

- Residential Properties: Single-family homes, condos, townhouses

- Commercial Properties: Office buildings, retail spaces, warehouses

- Land: Vacant land for future development

- Rental Properties: Properties leased to tenants for income

- Fix-and-Flip Projects: Properties purchased, renovated, and sold for a profit

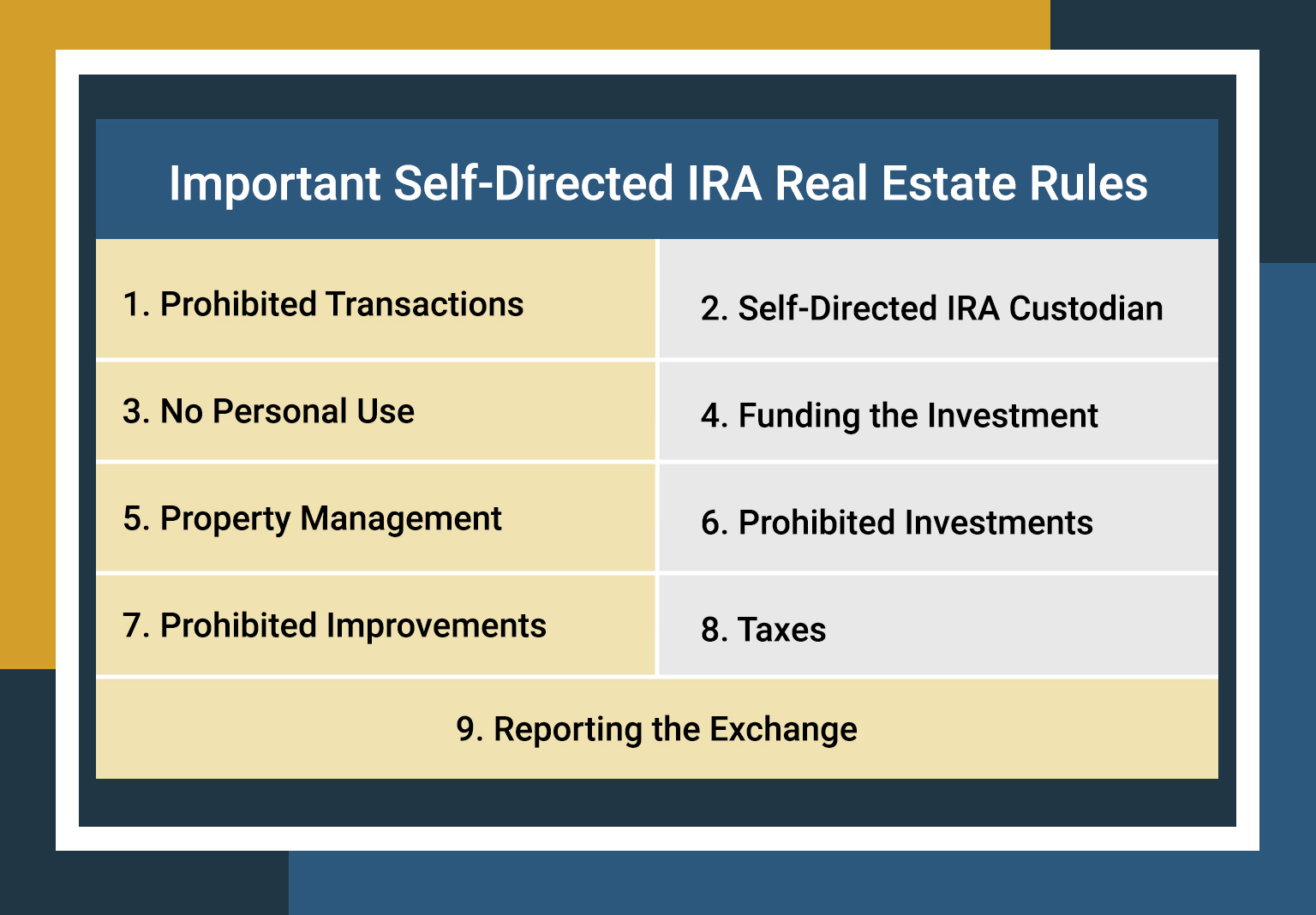

The Prohibited Transaction Rules

It's crucial to understand the prohibited transaction rules when investing in real estate with an SDIRA. These rules are designed to prevent you from personally benefiting from your IRA assets. Violating these rules can result in severe penalties, including the disqualification of your IRA, which would make the entire account taxable.

Some of the key prohibited transactions include:

- Direct or Indirect Benefit: You, your family (including your spouse, parents, children, and their spouses), or any disqualified person cannot directly or indirectly benefit from the IRA's assets. This means you can't live in a property owned by your SDIRA, rent it to a family member, or use it for personal gain.

- Providing Services: You cannot provide services to the property owned by your SDIRA, such as managing the property, making repairs, or acting as the real estate agent. These services must be performed by unrelated third parties.

- Purchasing from or Selling to Disqualified Persons: You cannot buy property from or sell property to yourself, your family, or any disqualified person.

- Using IRA Funds for Personal Expenses: You cannot use IRA funds to pay for personal expenses, such as travel, entertainment, or personal loans.

Setting Up Your Self-Directed IRA

Setting up a Self-Directed IRA involves several steps:

Choose a Custodian

Select a reputable SDIRA custodian that specializes in handling real estate investments. Research different custodians, compare their fees, and ensure they have the experience and expertise to manage your specific needs.

Fund Your Account

You can fund your SDIRA through contributions, rollovers from other retirement accounts (such as a 401(k) or traditional IRA), or transfers from existing IRAs. Be mindful of annual contribution limits, which are set by the IRS.

Establish an LLC (Optional)

Some investors choose to establish a Limited Liability Company (LLC) within their SDIRA. The SDIRA owns the LLC, and the LLC owns the real estate. This structure can provide additional control and flexibility, but it also adds complexity and costs. Consult with a legal and tax professional to determine if an LLC is right for your situation.

Find and Purchase Property

Work with a qualified real estate agent to find suitable properties that align with your investment goals. Conduct thorough due diligence, including property inspections, appraisals, and title searches. All transactions must be handled by your SDIRA custodian.

Due Diligence and Risk Management

Investing in real estate with a Self-Directed IRA requires careful due diligence and risk management. Here are some key considerations:

Property Valuation

Obtain a professional appraisal to determine the fair market value of the property. This helps ensure you're not overpaying and that your investment is sound.

Property Inspections

Conduct thorough property inspections to identify any potential issues, such as structural problems, mold, or pest infestations. Address these issues before purchasing the property.

Title Insurance

Purchase title insurance to protect against any claims or disputes related to the property's title.

Cash Flow Analysis

Carefully analyze the potential cash flow of the property, considering rental income, expenses, and vacancy rates. Ensure the property generates sufficient cash flow to cover expenses and provide a reasonable return on investment.

Liquidity

Real estate is generally considered a less liquid asset than stocks or bonds. Be prepared to hold the property for the long term, as selling it quickly may not be possible or may result in a loss.

Working with Professionals

Investing in real estate with an SDIRA requires a team of qualified professionals, including:

- SDIRA Custodian: To administer your account and ensure compliance with IRS regulations.

- Real Estate Agent: To help you find and purchase properties.

- Real Estate Attorney: To review contracts and provide legal advice.

- Accountant or Tax Advisor: To help you understand the tax implications of your investments.

- Property Manager: To manage your rental properties (if applicable).

0 Comments